€5 discount?

Discount code: KORTING

Akte van omzetting van een eenmanszaak in een BV beëdigde vertaling? Nu bestellen in webshop >

The procedure for converting a sole proprietorship into a BV

As the owner of a sole proprietorship, it can sometimes be advantageous to convert it into a private company (BV). A BV offers, among other things, a limited liability and tax benefits. To make this conversion possible, it is necessary to create a Deed of Transposition.

The Deed van Omzetting is een notariële deed in which all information regarding the conversion is recorded. This includes the name of the sole proprietorship, the new name of the BV, the share distribution and the appointment of directors.

The procedure

To convert a sole proprietorship into a BV, you must go through the following steps:

- Please contact one notary

- Say one Deed of Transposition op

- Let the deed register with the Chamber of Commerce

- Arrange any tax matters

The role of Ecrivus Multimedia

Ecrivus Multimedia is a translation agency specialized in sworn translations and apostilles. They can help you translate official documents as birth certificates, marriage certificates, diploma's and wills. They also offer legalization services for documents that need to be used abroad.

Other possible documents for translation:

- Drivers license

- Vehicle registration certificate

- Extract Basic Registration of Persons

- Declaration of conduct

Languages in which translations are possible:

- English

- Spanish

- French

- German

Conclusion

The Deed of Conversion is an important document for converting a sole proprietorship into a BV. It is essential to follow the procedure correctly and prepare the necessary documents on time. Hiring a professional translation agency such as Ecrivus Multimedia can help with this.

Frequently asked questions

What is a sole proprietorship?

A sole proprietorship is a form of business in which one person is the owner of the company and is therefore liable for all debts of the company.

What are the advantages of a BV?

A BV offers, among other things, a limited liability, tax benefits and more flexibility in attracting investors.

What does it cost to convert a sole proprietorship into a BV?

The costs of converting a sole proprietorship to a BV can vary depending on the notary and any tax matters that need to be arranged.

A Deed converting a sole proprietorship into a BV is one legal document that regulates the conversion of a sole proprietorship into a private limited company (BV). This conversion offers several advantages, such as limiting personal data liability of the entrepreneur and creating a distinction between the assets of the company and the personal assets of the owner.

Om een eenmanszaak om te zetten in een BV moet de ondernemer een notariële deed of conversion. In this deed include the statutes of the BV recorded, as well as the Handover of the assets and liabilities of the sole proprietorship to the BV. In addition, the entrepreneur must be notarized memorandum of association of the BV, in which, among other things, the name of the BV and the powers of the management are recorded.

Converting a sole proprietorship into a BV has tax consequences for the entrepreneur. This is what the conversion should be like tax are paid on the hidden reserves that have been built up in the sole proprietorship. In addition, the BV will have to pay corporate tax on the profit achieved, instead of the entrepreneur paying income tax on the profit of the sole proprietorship.

It is important to think carefully about the conversion of a sole proprietorship into a BV and vice versa legal and fiscal advice to be obtained before the decision is made. It is not always the best choice for every entrepreneur, so it is important to identify the pros and cons of the conversion and make an informed decision.

Converting a sole proprietorship into a BV can also have consequences for the legal position of the entrepreneur. For example, the retention of certain rights and obligations of the sole proprietorship may be jeopardized when converting to a BV. It is therefore wise to have the legal consequences of the conversion thoroughly investigated by a specialized lawyer.

In addition to the legal and tax aspects of converting a sole proprietorship into a BV, it is also important to: account take into account the practical consequences. For example adjusting contracts with suppliers and customers, changing the bank account and informing the tax authorities about the conversion.

In short, converting a sole proprietorship into a BV is a major decision with legal, tax and practical consequences. It is therefore very important to be well informed and advised before taking this step. However, with the right guidance and preparation, the conversion to a BV can provide many benefits for the entrepreneur.

Sworn translation you need, but do you have some questions first? We are ready for you. To our contact page you will find our details. You can call us at +31(0)43-365-5801 or e-mail us at . Op werkdagen tussen 09.00 en 17.00 uur kunt u uw vraag tevens stellen via onze Live Chat Support – wij reageren binnen 1 minuut.

Shipping with Track & Trace

All our translations are shipped with Track & Trace. Follow your translated documents safely to your home.

Recognised and trusted

Our webshop for sworn translations is unique in the Netherlands. 100% reliable, legal and secure. Best rated.

Secure online payment

Secure online payment via iDeal, PayPal or bank transfer. You can fully manage and track your order via My Account.

Apostilles & Legalisaties

2 Products

Sworn translations

129 Products

CV, cover letters

2 Products

Financial translations

4 Products

Legal translations

129 Products

Multimedia

13 Products

Notarial translations (notary)

11 Products

Sworn translations

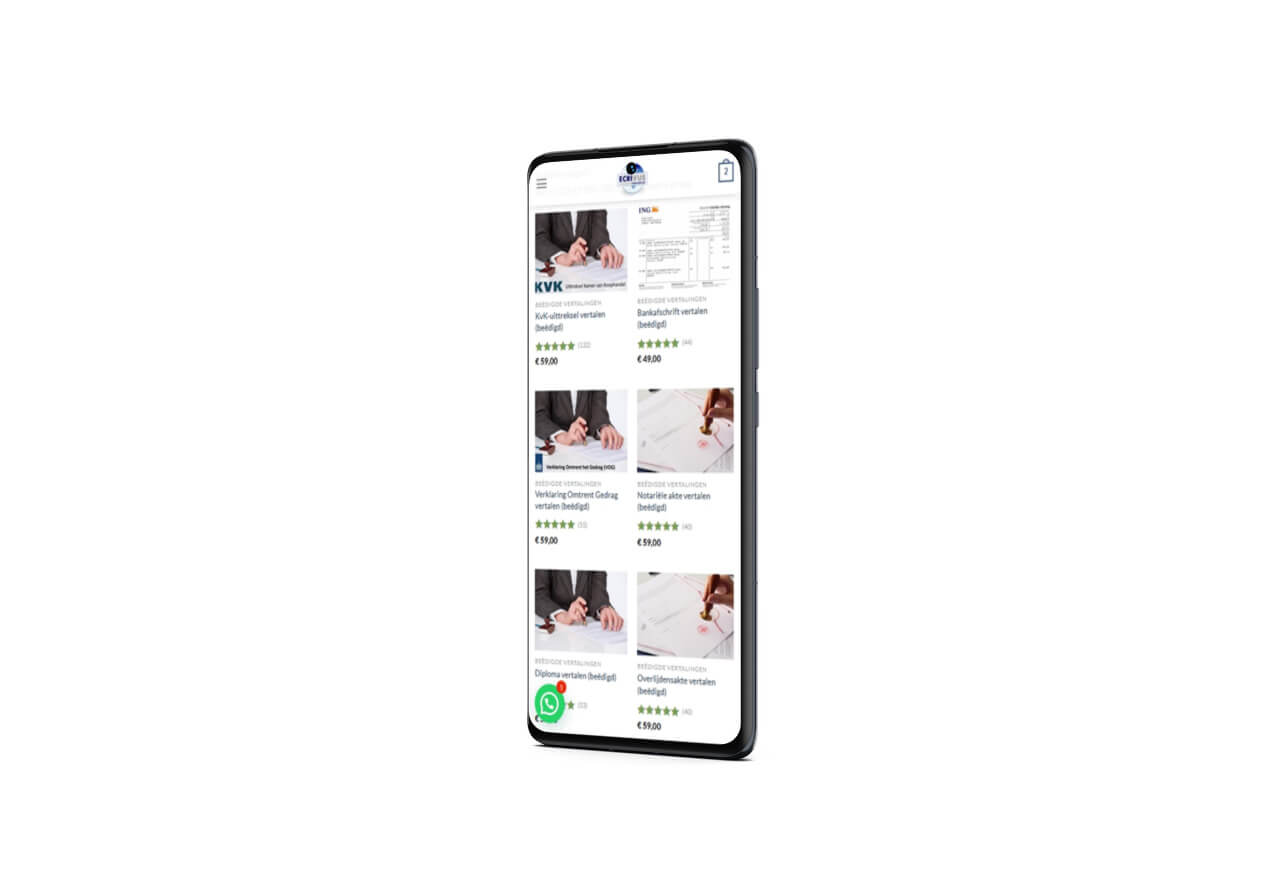

Trade register extract translation (sworn)

Sworn translations

Certificate of conduct translation (sworn)

Sworn translations

Diploma translation (sworn)

Sworn translations

Notarial deed translation (sworn)

Sworn translations

Translate death certificate (sworn)

Sworn translations

Bank statement translation (sworn)

Sworn translations

Translate birth certificate (sworn)

Sworn translations

Translation of marriage certificate (sworn)

Sworn translations

Certificate of inheritance translation (sworn)

Sworn translations

Translate divorce certificate (sworn)

Sworn translations

Extract from the register of births, deaths and marriages (BRP) translated (sworn)

Sworn translations

Legal document (sworn)

Sworn translations

Translation of marriage contracts (sworn)

Sworn translations

Translation of wills (sworn)

Sworn translations

Grade list translation (sworn)

Sworn translations

Passport translation (sworn)

Sworn translations

Translate identity document (sworn)

Sworn translations

Order translation (sworn)

Legal translations

Translate general terms and conditions (unsworn)

Albanië

KvK-uittreksel met apostille (rechtsgeldig)

Sworn translations

Translate medical records (sworn)

Sworn translations

Translate driving licence (sworn)

Sworn translations

Translate tax returns (sworn)

Sworn translations

Declaration of Dutch citizenship translated (sworn)

Sworn translations

Declaration translation (sworn)

Sworn translations

Power of attorney translation (sworn)

Sworn translations

Invoice translation (sworn)

Sworn translations

Child recognition declaration translated (sworn)

Sworn translations

Residence permit translation (sworn)

Web & App development

PHPbb Forum Installation Service