€5 discount?

Discount code: KORTING

Btw-aangifteverklaring beëdigde vertaling? Nu bestellen in webshop >

The meaning of a VAT return statement for sworn translations

A VAT return statement for sworn translations is a document in which a translation agency declares that the translations they provide meet all legal requirements and that they have paid VAT on the services provided. This document is essential for companies and individuals who sworn translations need for official purposes, such as legal documents, diploma's, deeds and more.

Ecrivus Multimedia: specialists in certified translations and apostilles

Ecrivus Multimedia is a full-service translation agency specialized in sworn translations and apostilles. With a team of experienced translators and interpreters, they offer high-quality translation services in more than 35 languages. Next sworn translations they also offer apostilles on, with what official documents be internationally recognized.

Other types of official documents that can be translated

Ecrivus Multimedia translates a wide range of official documents, under which:

- Passports

- Birth and marriage certificates

- Criminal records

- Contracts

- Diploma's and certificates

- Notarial deeds

- Wills

- Medical documents

- And much more.

Languages in which translations are available

Ecrivus Multimedia offers translations in more than 35 languages, including:

- English

- Spanish

- French

- German

- Italian

- Chinese

- Arabic

- Russian

- Portuguese

- Dutch

- And many other languages.

Conclusion

A VAT return statement for sworn translations is an important document for companies and individuals who need official translations. By choosing a reputable translation agency such as Ecrivus Multimedia, you can rely on high-quality translation services that meet all legal requirements.

Frequently asked questions

1. Do I need a VAT return statement for sworn translations?

Yes, it is important to have a VAT return statement for sworn translations, as this demonstrates that the translations meet all legal requirements.

2. What is the difference between certified translations and regular translations?

Sworn translations are carried out by sworn translators who are officially recognized by the court. These translations are valid for legal and official purposes.

How long does it take to have a certified translation made?

The lead time for one sworn translation may vary depending on the complexity of the document and the language to be translated. It is advisable to contact the translation agency in advance.

As sworn translator in the Netherlands you are obliged to pay VATdeclaration to do for your services. This means that you must complete a tax return every so often and submit it to the Tax Authorities. In this statement indicate how much turnover you have made, how much VAT you have paid and how much VAT you have to pay.

It is important to know that the VAT you incur account brings to your customers must be stated separately on your invoices. This applies to both national and international customers. Make sure that your invoices meet the legal requirements and that you apply the correct VAT rates.

As sworn translator you have to go there account Please note that VAT rules may differ per country. If you provide services to customers abroad, you need to be well aware of the VAT rules in that specific country. This way you avoid problems and fines later.

It is advisable to keep good records of all your income and expenses sworn translator. This makes it easier to complete your VAT return statement and to answer any questions from the tax authorities. Make sure you keep all necessary documents and receipts.

As sworn translator you are obliged to submit the VAT return statement digitally to the Tax Authorities. This can be done via the online portal or via special software for VATdeclaration. Make sure you submit your application on time declaration, otherwise you risk fines and interest costs.

It may be useful to have one fiscal to contact an advisor if you are not sure how to complete the VAT return statement or if you have questions about your tax obligations if sworn translator. An advisor can help you take maximum advantage of tax benefits and avoid mistakes.

Finally, it is important to know that the Tax Authorities carry out random checks on the accuracy of VAT returns. Therefore, make sure that you are always honest and transparent in your declarations and that you state all necessary information correctly. This prevents problems and ensures that you... sworn translator properly meets your tax obligations.

Sworn translation you need, but do you have some questions first? We are ready for you. To our contact page you will find our details. You can call us at +31(0)43-365-5801 or e-mail us at . Op werkdagen tussen 09.00 en 17.00 uur kunt u uw vraag tevens stellen via onze Live Chat Support – wij reageren binnen 1 minuut.

Shipping with Track & Trace

All our translations are shipped with Track & Trace. Follow your translated documents safely to your home.

Recognised and trusted

Our webshop for sworn translations is unique in the Netherlands. 100% reliable, legal and secure. Best rated.

Secure online payment

Secure online payment via iDeal, PayPal or bank transfer. You can fully manage and track your order via My Account.

Apostilles & Legalisaties

2 Products

Sworn translations

129 Products

CV, cover letters

2 Products

Financial translations

4 Products

Legal translations

129 Products

Multimedia

13 Products

Notarial translations (notary)

11 Products

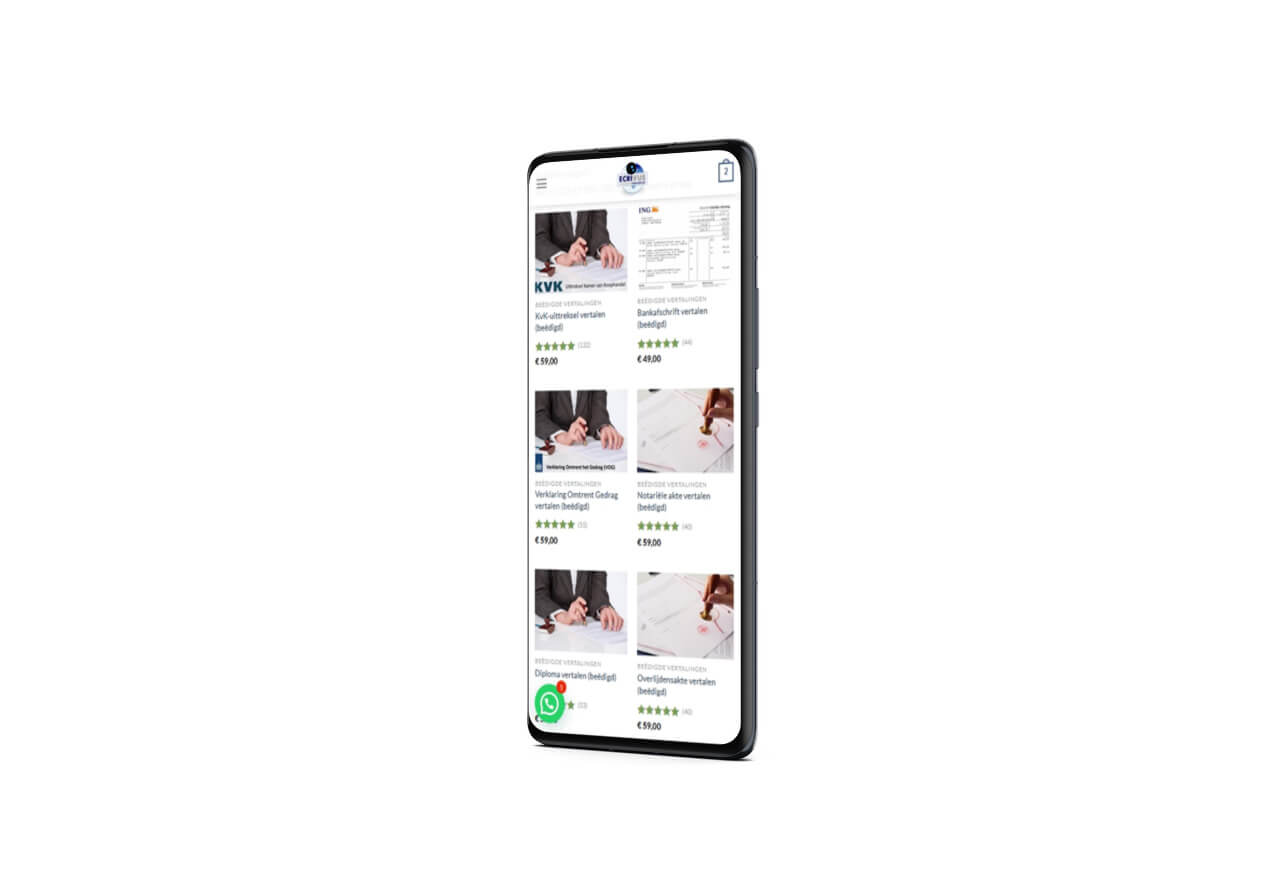

Sworn translations

Trade register extract translation (sworn)

Sworn translations

Certificate of conduct translation (sworn)

Sworn translations

Diploma translation (sworn)

Sworn translations

Notarial deed translation (sworn)

Sworn translations

Translate death certificate (sworn)

Sworn translations

Bank statement translation (sworn)

Sworn translations

Translate birth certificate (sworn)

Sworn translations

Translation of marriage certificate (sworn)

Sworn translations

Certificate of inheritance translation (sworn)

Sworn translations

Translate divorce certificate (sworn)

Sworn translations

Extract from the register of births, deaths and marriages (BRP) translated (sworn)

Sworn translations

Legal document (sworn)

Sworn translations

Translation of marriage contracts (sworn)

Sworn translations

Translation of wills (sworn)

Sworn translations

Grade list translation (sworn)

Sworn translations

Passport translation (sworn)

Sworn translations

Translate identity document (sworn)

Sworn translations

Order translation (sworn)

Legal translations

Translate general terms and conditions (unsworn)

Albanië

KvK-uittreksel met apostille (rechtsgeldig)

Sworn translations

Translate driving licence (sworn)

Sworn translations

Translate tax returns (sworn)

Sworn translations

Declaration of Dutch citizenship translated (sworn)

Sworn translations

Declaration translation (sworn)

Sworn translations

Power of attorney translation (sworn)

Sworn translations

Invoice translation (sworn)

Sworn translations

Translate medical records (sworn)

Sworn translations

Child recognition declaration translated (sworn)

Sworn translations

Residence permit translation (sworn)

Web & App development

PHPbb Forum Installation Service